• By providing payroll, benefits, and HR services and assisting with compliance issues under state and federal law, PEOs help small businesses to improve productivity and profitability, to focus on their core mission and to grow. • Businesses that use PEOs grow 7 to 9 percent faster, have employee turnover that is 10 to 14 […]

New Department of Labor Rules for Business Owners

Business owners who join a PEO will get an advantage January 2024, The Biden administration issued a new rule Tuesday intended to put more contractors on company payrolls, a change that could reverberate across a range of industries, including healthcare, restaurants, construction and transportation. The rule, which will go into effect in March 2024, would […]

June 2023 Regulatory Compliance Changes for Employers

Form I-9 updated employer procedures and requirements. On May 5, 2023, the U.S. Department of Homeland Security and U.S. Immigration and Customs Enforcement released an announcement stating employers had 30 days to comply with Form I-9 requirements after the COVID-19 flexibilities sunset on July ’31, 2023. Employers must ensure that all required physical inspection of […]

Indiana Congresswoman Addresses Congress about the importance of PEOs for small businesses

On April 17, 2023 Erin Houchin noted to the US congress that May 21 through May 27, 2023 was National PEO week. Here is the text of her address: COMMEMORATING NATIONAL PEO WEEK HON. ERIN HOUCHIN of Indiana in the U.S. House of Representatives – Monday, April 17, 2023 Mrs. HOUCHIN. Mr. Speaker, I rise […]

Alabama Passes the Employers Adoption Promotion Act (APA)

As of July 1, 2022, Alabama’s Adoption Promotion Act (APA) requires employers with 50 or more employees to provide eligible employees with up to 12 weeks of unpaid family leave for the birth or adoption of a child. This also provides that additional family leave due to the adoption of an ill child or a […]

Florida Work Comp Insurance Rates to Decrease in 2023

On November 7, 2022 the Florida Office of Insurance Regulation Approved an 8.4% Decrease in Workers’ Compensation Insurance Rates for 2023. This decrease will be effective for both new and renewal work comp policies. Florida Insurance Commissioner David Altmaier granted approval to the National Council on Compensation Insurance (NCCI) for a statewide overall workers’ compensation […]

Covid Pandemic Effects on Workers Compensation Insurance costs for Employers

While the impact has yet to be fully understood, it can only be assumed that Workers’ Compensation Insurance carriers who are facing rising costs from lawsuits may be forced to pass those costs on to their customers in the form of higher work comp rates. Recently there have been a number of law firms advertising […]

How Inflation is Affecting Small and Medium Sized Businesses

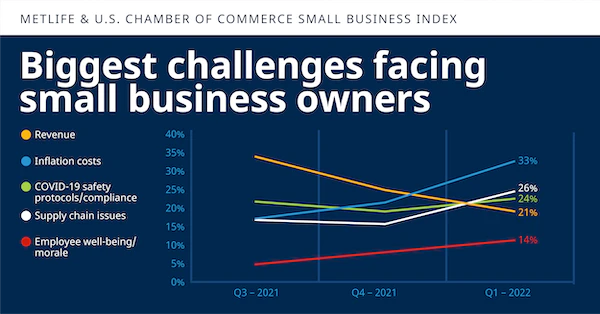

Inflation Impacts for Small and Medium Sized businesses (SMB).

Winning the Battle for Workers – How a PEO can help

Joining forces with a PEO can make your company or more attractive employer for job prospects. On January 5th , 2022 the Wall Street Journal reported that workers quit their jobs at a record rate in November 2021. Workers Quit Jobs at a Record Level in November – WSJ Click the button to “READ ARTICLE”. […]

PEOs Prove Their Value Through the COVID-19 Pandemic

As the ramifications of the COVID-19 Pandemic swept through the USA in 2020 and 2021, small businesses who have partnered with a Professional Employer Organization (PEO) have shown a higher survivability rate than those who have not. Many businesses are finding it more challenging to attract workers and the competition for quality employees is increasing. […]