Reducing Unemployment Insurance Costs / UI and SUTA State Unemployment Taxes

Many business owners and managers think that State Unemployment Taxes (SUTA) are just another cost of doing business. Suck it up, pay the bill and get back to work. However, businesses do actually have more control over these costs than they might think and many times the cost savings can be significant. This article will discuss how SUTA - UI taxes are calculated and discuss some ways that SUTA tax cost can be reduced.

Employee Turnover and SUTA costs – The Hidden Cost Driver

State Unemployment Taxes are calculated for each individual employee each year. Each state has a wage cap used for the SUTA calculation that once reached, stops the further liability for additional SUTA tax amounts. Each time an employee quits (who has reached the SUTA wage cap) and a new person is hired, the SUTA obligation starts anew for the newly hired person. The net result is that employee turnover can be a significant factor in driving higher SUTA costs. It does not matter whether the person quit or was fired or if they file an unemployment insurance claim. The SUTA liability is calculated on the wages (up to the wage cap) of every employee that worked during the year. Companies with high employee turnover and relatively low wages have the most SUTA financial impacted from turnover. Visit this page to estimate how much employee turnover may be affecting your company’s UI and SUTA costs.

How SUTA Is Calculated

To understand what you can do to reduce your SUTA costs, you first need to understand how it is calculated. Two components are used to calculate your SUTA liability: Your assigned SUTA rate is multiplied by your wages paid that are subject to SUTA taxes (SUTA subject wages). Let’s review each component.

Component #1) Your Company’s assigned SUTA rate

This value is created and assigned to your company by the Workforce board (or other state agency) in each individual state where you have employees. Each state in the USA has their own methods, rules and rating systems for how they assign a SUTA rate to your company. The rating assigned to a company’s FEIN and is meant to collect more SUTA tax from companies who have terminated employees (and cost the state’s UI fund more money in claims) and less from those who have not. SUTA rates are meant to be “experience” based so that your SUTA rate (and tax bill) will be higher or lower based on how many unemployment claims have been filed against your company. In addition each state has different periods of time for which your rating may be affected by a claim. Your SUTA experience rate may be affected for employees that were terminated years ago (and were rehired by someone else) but who have only recently filed an unemployment claim. For example it may be deemed “unfair” to impact a company’s experience rating for a long period of claims when the company only employed an individual for a short period of time. In these cases the rating agency may “look back” and charge all of the claimants former employers over the last several years and not just the most recent employer. To find the state agency that assigns the SUTA experience rating for your company click here.

-

Minimum and Maximum SUTA rates

Each state has a minimum SUTA rate and a maximum SUTA rate that can be charged to a company. The minimum rate is of course for companies that have long track records of paying wages and no unemployment claims from prior employees. The maximum rate can be charged by the state to employers who have a high number of unemployment claims from their former employees. For some employers even the maximum rate does not really cover the cost to the states UI fund for the claims. In those cases the statue UI fund “socializes” the costs and spreads the shortfall by charging a slightly higher rate to all of the other employers in the state. Click here to see the SUTA minimum and maximum rates for your state.

-

New Business SUTA Rates

For new companies that do not have an experience rating with the state, a new business rate is established and used until the company has been in business long enough to establish an experience rating. Each state has slightly different periods before a rating will be assigned. States work to keep rates new business SUTA rates low for new businesses to encourage their formation. In addition some states have a higher new business rate for certain types of business like construction, which, as an industry, tends to have higher UI claims. Click here to see the new business SUTA rate for your state.

Component #2) The amount of total wages subject to SUTA taxes – known as SUTA Subject Wages

The second factor that affects your SUTA tax liability is the amount of wages you pay and the number of employees you have. SUTA taxes are charged to your company for each employee for each year up to a maximum wage value (cutoff value) for the employee. Once the employee’s yearly earnings have reached the cutoff value, earnings for the employee for that year no longer are included in determining the SUTA subject wages. This cutoff value is known as the state wage base. Each state has different values for the wage base used to calculate SUTA. Click here to see the SUTA wage base for your state. To recap: SUTA subject wages are the total of all wages paid to each employee up to the wage base in the calendar year.

Here is an example of how to calculate SUTA subject wages

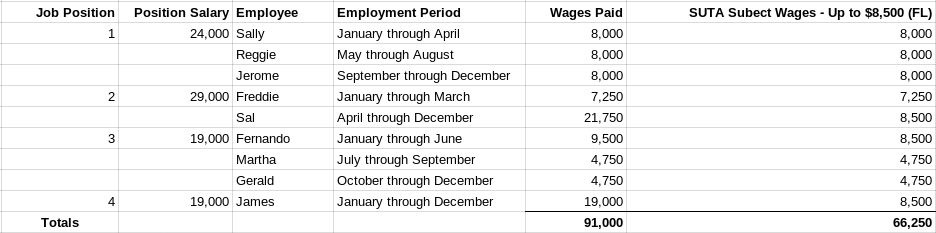

State: Florida – Wage base cutoff value=$8,500

SUTA subject wage example 1

In this example the company has 4 positions that were filled by the various employees. Notice that only Sal and James had wages beyond the SUTA wage cap. In this example the total wages are $91,000 and the SUTA subject wages are $66,250.

Your SUTA Tax Bill Amount

Your SUTA liability to the state is your company’s assigned SUTA rate (discussed above) multiplied by your SUTA subject wages. In our example 1 above, the SUTA liability for a new business in a state with a 2.7% rate (most states new business rate) will be:

$66,250 x 2.7% = $1,789

What can you do to reduce your SUTA Tax liability?

As explained, your company’s SUTA taxes are the product (multiplication) of your experience rating and your SUTA subject wages. Reducing either or both components will reduce your SUTA tax bill. Reducing your company’s turnover can have an immediate impact on your SUTA taxes because it may reduce the amount of SUTA subject wages. In the example above (SUTA Wage Example 1) the SUTA obligation was $1,789. Let’s now calculate what the SUTA obligation would be if the company had no turnover in the four positions. I.E. All 4 persons working the positions stayed employed the whole year.

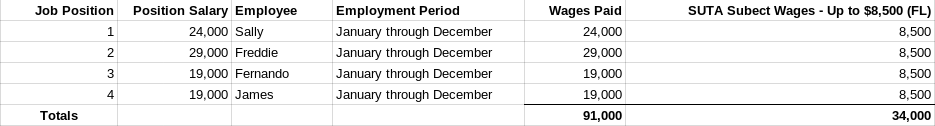

SUTA SUBJECT WAGE EXAMPLE 2 - No Turnover

Notice the SUTA Subject wages are now reduced from $66,250 to $34,000. Multiplied by the same 2.7% rate, yields a SUTA obligation reduced to $918. For this example, eliminating employee turnover cut SUTA taxes nearly in half even though the experience rate was unchanged. Reducing employee turnover will also have the long term benefit of lowering your experience rating, but the short term benefit of lowering your SUTA subject wages can be just as significant and provide immediate cost savings. Of course this example is small in dollar amount because the excercise was done for a small company, however the savings are directly scaleable for larger companies.

How to Reduce Your Company’s SUTA experience rate

Avoid terminations and layoffs if possible

Every time your company terminates an employee and that employee files a claim for unemployment benefits, your experience rating with your states workforce board will track that claim and it will then cause your SUTA rate to be increased unless you are already at the maximum rate. Find ways to avoid layoffs by moving them to other tasks or areas will help keep SUTA cost in line. Avoid firing in one department and hiring in another when skills sets may be transferrable or cross training may be acceptable.

Follow sound HR practices

Ensure that your HR practices are sound, employee performance appraisals are conducted professionally and employee terminations are well documented when necessary. Many companies with poor HR practices terminate employees who later file unemployment claims that may have been contestable. However, without written documentation demonstrating that a termination was for cause, most state Workforce boards will approve the claims, and the consequence will be a higher SUTA experience rating for your company.

Contest Questionable Unemployment Claims

To keep your rate from being adversely affected you must contest all questionable unemployment benefit claims made against your company. While most claims may be legitimate, many claims are approved by workforce boards when there was actually a termination for cause. Unfortunately it is difficult and time consuming for most employers to track claims made against their company, be at the meeting with the workforce board and provide the necessary documentation for contesting a UI claim. As a consequence many business owners are unaware of the claims made against them and are ill-prepared to successfully contest the Unemployment Insurance claim.

How is SUTA handled when a company joins a Professional Employer Organization?

The short answer is… it depends. States have differing rules for how SUTA is handled when a company joins a PEO. There are two scenarios possible:

PEO SUTA Rate / PEO Level Reporting

Company wages are reported under the FEIN of the PEO. The company’s SUTA taxes are calculated, reported and paid by the PEO to the state using the experience rating of the PEO.

Company SUTA Rate / Client Level Reporting

Company wages are reported under the FEIN of the PEO but the company’s SUTA taxes are calculated, reported and paid by the PEO to the state using the experience rating of the company.

In some states PEO are allowed to “declare” the SUTA reporting level they will use when they operate in the state. The PEO must pick one of the methods above for all of their client companies and are not allowed to change it. In addition, PEOs that use PEO level reporting may charge the client company at a rate that differs from their PEOs experience rating.

How can joining a Professional Employer Organization help reduce SUTA and UI taxes?

A PEO can help a company reduce SUTA expenses in several ways:

Provide HR services and guidance on practices that reduce employee turnover.

For most businesses, reduced employee turnover drives increased SUTA cost savings in the short run (SUTA subject wages) and in the long run by reducing the number of claims and thus the experience rating.

Reduce the frequency of successful UI claims and contest questionable UI claims

A PEO is a motivated partner in keeping unemployment claims as low as possible. All PEOs have staff that are experts in this area and will work to ensure that questionable claims are contested. Uncontested claims eventually result in a higher SUTA experience rate for the company or the PEO. Unfortunately some employees voluntarily quit their jobs and then file a claim for Unemployment Insurance. When this happens, the state Workforce agency will most often rule in favor of paying the claim unless the employer can demonstrate that the separation was the action of the employee. Even more common is when an employee is terminated for cause and then files a UI claim. In these cases the employer must be able to demonstrate a series of documented written warnings to the employee. Otherwise many Workforce boards will approve the claim. In each circumstance, companies that hire a PEO will have followed HR practices that improve the odds of successfully contesting a claim which in turn keeps SUTA experience rates in check.

Summary

For many businesses, taking steps to reduce employee turnover yields short term benefits in reducing SUTA taxes by lowering the SUTA subject wages. In the long term, it lowers their SUTA experience rate also and provides even further cost savings. Joining forces with a Professional Employer Organization or PEO may help a business realize cost savings for Unemployment Insurance taxes.