Employee Health Coverage Reporting Changes affect PEOs and PEO clients in 2013

Affordable Care Act requires 2012 W2 information to include value of employer sponsored health coverage

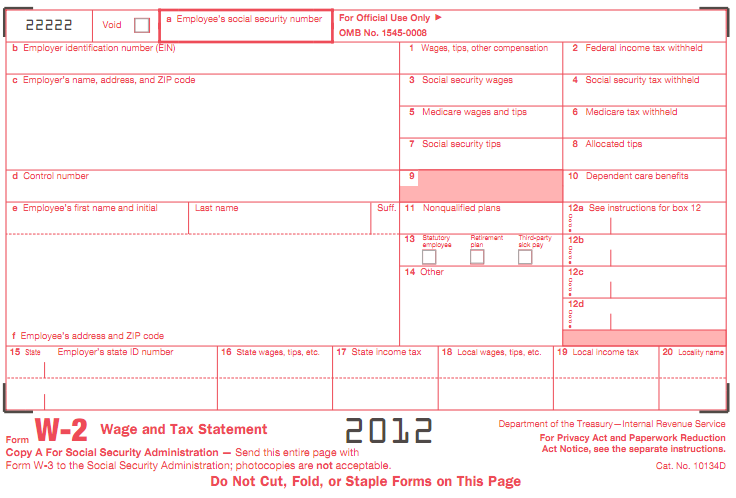

Effective for federal W2s for the calendar year 2012 (issued in early 2013), companies and employees working with a Professional Employer Organization will notice that the value of employer sponsored health coverage is now included on the employees W2. The value of the coverage will be shown in W2 form Box 12 with code DD.

Value of Employer Sponsored Health Coverage Not Taxable

The IRS has been emphatic that the new values required to be reported are not taxable and that the sole purpose of the change was to make employees aware of the total cost of their employer sponsored plans. Many employees pay a payroll deduction for some of the cost of their health plans and amounts to be reported include both the employer and employee amounts.ACA – IRS guide for employers – reporting group health insurance costs

PEOs Get Ready

The IRS provisions for the reporting requirement was deferred for small employers in 2012 due to concerns that many small employers would not have time to amend their systems to report these values in an accurate and timely fashion. For 2012 W2s (issued in 2013), employers who issued fewer than 250 W2s the prior year (2011) the reporting requirement is optional. This means that small businesses who use their own software or even those that use a third party payroll service are not required to report the value until issuing W2s for calendar year 2013. The “transition relief” period established by the IRS does not apply to most PEOs since in a true PEO relationship, the PEO is the employer of record (W2s issued under the EIN of the PEO) and will have issued over 250 W2s the prior year (2011). The net result is that for PEOs, the reporting requirement is effective now (for 2012 W2s). Small businesses who offer an employer sponsored health plan and are not currently using a PEO should review the IRS reporting guidance for employer sponsored health coverage.

ASO versus PEO

Businesses who are engaged with an Administrative Services Organization (ASO) and less than 250 employees will still be exempt from the reporting requirement for the tax year 2012, however it may be wise to get ready this year. Business who use an ASO to provide payroll and HR administrative services will need to work with their ASO operations department and insurance agents to make sure the are ready to meet the new reporting requirements.

What is included in the Reporting Requirements?

In general the requirement is for reporting for the total amounts paid for major medical insurance and for other specific situations. See the grid located here to get the IRS guidelines for what needs to be included.Health insurance reporting requirements, what is in included.