Owner destroys business with one stupid move

How to become uninsurable by punching out an employee

At StaffMarket we have reviewed the workers compensation situation for thousands of small businesses across the USA. This week we had a submission from a company hoping to obtain work comp coverage by hiring a Professional Employer Organization. The business has two restaurants in Jacksonville, Florida. The business was seeking some options that provided workers compensation coverage for their employees as required by law. Part of the work comp insurance underwriting process involves insurance carriers reviewing the “loss history” for the company which details the various situations and associated financial costs related to workers’ compensation claims over the last several years.

A bad mod rate is just the start of the bad news

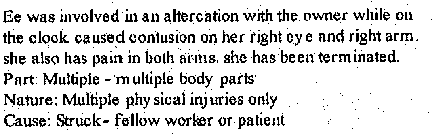

The mod rate or modifier is a number used to adjust the workers’ compensation insurance premiums based on the company’s history of claims against the work comp policy. The restaurant in question already had a mod rate of 1.6 (160% over normal) due to its history of claims. But the real kicker is what was in the claims documentation. It turns out that the business owner decided to punch out a female employee! While not all the details about the incident are disclosed, what is known is what appears on the loss history as documented by the business’s current work comp carriers.

So it appears that the business owners decided to discipline an employee by punching her out and then fired her. Holy moly, you can’t make this stuff up. After this incident, the business owner is shocked to learn that they cannot find workers compensation insurance or find a PEO to take on the employers risk from their Human Resources practices.

Let’s take a quick review of the possible outcomes of this event.

- Open claims for the punch out incident. The case is not yet closed and any new insurance carrier will be on the hook for an unknown length of time and an unknown amount of damages.

- Potential lawsuit for assault and/or battery

- Potential lawsuit for wrongful termination

- Potential lawsuit for sexual harassment

- Potential lawsuit for a hostile work environment

From a work comp standpoint this situation is made worse by the fact that the abuse was at the hands of the business owner rather than a manager. If it had been a manager, the business would at least be able to terminate the manager and settle the matters and get back to business. In this case the owner cannot fire himself and that makes it tough to make a case to the insurance carrier that it will not happen again. The bottom line is that this business is uninsurable with any carrier with the exception of the Florida JUA (state fund) where the work comp rates will be triple the costs.

Why a PEO would not touch this account

This case is literally a poster child for the kind of client PEOs want to avoid. In addition to workers’ compensation insurance, PEOs are in many cases the employer of record and thus can be named in employment related lawsuits for acts like wrongful termination or other HR related legal affairs. Because of that financial risk PEOs partner with their business clients to implement and maintain solid and legally defensible human resources practices. The owner of this company needed a PEO yesterday. Today he has made himself uninsurable and probably will be out of business soon.