Over the last 15 years many employers and companies that have joined a PEO have implemented payroll cards as an alternate method of making wage payments to their employees. Instead of a paper check, the employer transfers the employee wage payment to a payroll card account maintained by the employer’s bank or a different bank established by the employer’s payroll card vendor. That bank issues payroll cards to the employees and processes all of the payroll card transactions just like a debit card. At the end of every payroll period, the payroll card account is reloaded with the employees’ payroll wages.

Payroll Card Benefits for Employers

Many employers like these “Paycards” or “payroll debit cards” since they are often a more efficient way to make payroll disbursements than by a physical check and can reduce the overall payroll processing costs. For companies with workers who are not regularly at a known physical location, paycards prevent workers from having to travel to a home office to get their check or having a “runner” take the checks out to the workers.

Payroll Card Benefits for Workers

Forget the Paycheck (Johnny), put in on my Payroll Card! Employees do not need a bank account to participate in the program, and they can participate regardless of their creditworthiness. For many employees this is easier than direct deposit, where employees have to provide personal bank account information to their employer simply to get paid. In addition, they do not need to spend time and money at check cashing outlets to access their payroll funds. Payroll cards are often branded by MasterCard™ or Visa™ and can be used where debit card transactions are accepted. Employees can make cash back transactions and withdraw cash – without the need for a credit card. Employees also have access to an FDIC-insured account that provides them with protection for fraudulent charges. In addition, many workers are “unbanked” meaning they navigate life without the benefit of any bank account. For those workers, direct deposit does not work where payroll cards do.

Employers Can’t Force It

The Fair Labor Standards Act (FLSA) generally requires employers to pay nonexempt employees at least the applicable minimum wage and overtime compensation and exempt employees a minimum weekly salary. Wages are not considered paid unless they are received by the employee “free and clear.” This requirement is not satisfied if the employee must “kick back” a portion of his or her wages to the employer, either directly or indirectly. Some payroll card vendors have been offering to pay employers a piece of the transaction fees collected when employees use their payroll cards. This “kick back” provision could create problems for employers if the payroll card vendor offers a commission or other payment to the employer as an incentive to enroll employees. Employers should use caution with these proposed arrangements. The Electronic Fund Transaction Act (“EFTA”) is the only federal regulatory act that specifically deals with payroll cards. (See 15 U.S.C. §§1693 to 1693r) Regulation E is the EFTA’s implementing regulation, and it explicitly provides that no employer can require employees to receive direct deposit into an account at a particular financial institution. Therefore, employers cannot require employees to participate in a payroll card program unless the employees can choose the bank and have the option of receiving wages by another method, such as cash or check.

Lawsuits have been filed against employers, alleging that wage payment by payroll cards violates state and federal law since many payroll card programs charge fees for various card-related activities such as ATM withdrawals, account opening and closing, account maintenance, account balance inquiries and account overdrafts. When those fees impact the take home pay of low-wage workers, there is a potential violation of wage and hour laws if sub-minimum wages are the result of these fees. In addition, some of the fee disclosures issued to the employees have been scrutinized because employees with limited English proficiency or limited access to the internet.

States Get Involved

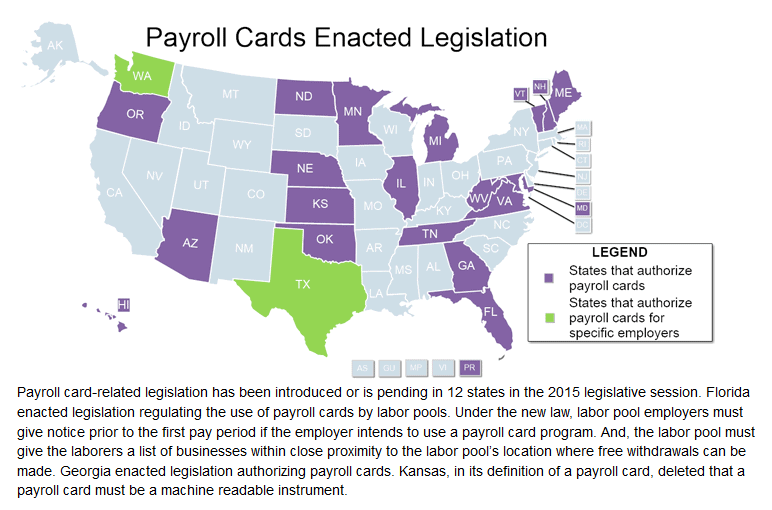

Several states have created their own rules regarding the use of payroll cards to pay wages. A key feature in most state’s rules are that the employee have access to the full amount of his or her wages on regular paydays, at no cost. These laws also typically include a provision that the payroll card agreement outline the terms and conditions of the program at the outset of its use. As of May 21, 2015, twenty one states and Puerto Rico have enacted legislation regarding the use of payroll cards. Legislation in 19 of those states: Arizona, Florida, Georgia, Hawaii, Illinois, Kansas, Maine, Maryland, Michigan, Minnesota, Nebraska, New Hampshire, North Dakota, Oklahoma, Oregon, Puerto Rico, Tennessee, Vermont, Virginia and West Virginia and Puerto Rico apply to any employers, while Texas and Washington enacted legislation specific to specific employers. In Georgia for example, every employee must be provided with a written explanation of any fees associated with the payroll card AND provide them with a form that allows them to opt out of the payroll card payment and request either a paper check or direct deposit.

A full breakdown of state specific laws regarding payroll cards can be found here.

How joining a Professional Employer Organization can help.

As of December 2015, 64% of the 400+ PEOs participating at StaffMarket offer payroll card services to their client companies and associated worksite employees. PEOs are well aware of the advantages and pitfalls of payroll cards. Since governmental regulations are a moving target (in each state) companies that join a PEO can be confident that offering something as effective and convenient as payroll cards will minimize regulatory risk and ensure they are abiding by the rules .