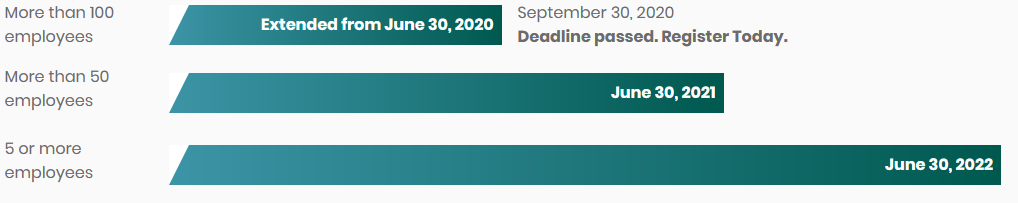

The State of California is implementing a phased in mandatory retirement program to improve workers access to retirement savings tools. Employers with five or more employees in California must either offer a qualified employer-sponsored retirement plan or participate in the state’s Individual Retirement Account (IRA) program known as CalSavers, effective June 30, 2022.

Qualified Employer-Sponsored Plans

The CalSavers website states that a qualified retirement plan includes any plan that is qualified under Internal Revenue Code sections 401(a) (including a 401(k) plan), a qualified annuity plan under section 403(a), a tax-sheltered annuity plan under section 403(b), a Simplified Employee Pension (SEP) plan under section 408(k), a Savings Incentive Match Plan for Employees of Small Employers (SIMPLE) IRA plan under section 408(p) or a payroll deducted IRA with an automatic enrollment feature.

If your company has five or more employees in California and already offers a qualified employer-sponsored retirement plan, you are exempt from having to participate in the state program. However, employers need to certify their exemption by going to CalSavers.com or by contacting CalSavers Client Services at 855.650.6916.

Employers who are utilizing the services of a Professional Employer Organization and are obtaining employee access to a 401K plan should also contact their PEO to confirm the process for obtaining the exemption. Employers with five or more employees in California considering joining a PEO to obtain access to employee benefits like retirement plans should contact StaffMarket to streamline their search for the right California Professional Employer Organization for their company.