The long process for the Internal Revenue Service to establish a certification process for Professional Employer Organizations has been completed in June 2017. The Small Business Efficiency Act of 2014 established an Internal Revenue Service program providing “Certification” to PEOs who apply for and meet the IRS’s CPEO program requirements.

Clients and prospective clients of any PEO may need to understand some things about this IRS certification. First of all there is no legal requirement for a PEO to gain IRS certification. It is entirely up to each PEO to determine if they want to incur the additional cost and administrative burden of obtaining and maintaining IRS certification.

About the IRS Certification Program

The Small Business Efficiency Act (SBEA) modified the Internal Revenue Code, and provided statutory authority for those PEOs that have elected to pursue IRS certification. IRS certified PEOs (CPEOs) are officially authorized by the IRS to collect and remit federal employment taxes under the PEO’s Employer Identification Number (EIN) for wages paid to worksite employees. PEOs that choose to participate in the IRS certification program must meet specific requirements regarding tax status, background, industry experience and financial reporting. The IRS process for a PEO to obtain and maintain IRS certification requires:

- Payment of an annual fee to the IRS

- Background verification and tax compliance history review of PEO owners and stakeholders

- Submission of third party CPA opinion statements and annual audited financial statements

- Independent surety bonding for federal tax liabilities

The IRS certification program requires a CPEO to post a bond each year guaranteeing payment of its federal employment tax liabilities. Bonding for the PEOs must be set to 5% of their collective annual federal tax liabilities with a minimum of $50K up to a maximum of $1M.Full Rules for CPEOs are available in IRS Internal Revenue Bulletin 2017-3 Rev. Proc 2017-14.

Why did the IRS offer a certification program for PEOs?

It’s really pretty simple; avoiding bad press for the PEO industry. Over the last twenty years there have been a few PEOs that have gone out of business either through mismanagement or (rarely) outright fraud. As in every industry with a fiduciary responsibility to customers there will be mistakes and some bad actors; banking, investing and insurance have all had some high-profile failures. In our twenty years as industry advisors we have seen only a very, very few PEOs fail and the vast majority of client/PEO relationships successfully last for decades. As for potential tax fraud by a PEO who collects employment related taxes and then fudges on the IRS deposits, the threat of being sentenced to federal prison is a pretty good deterrent. In the few cases where a PEO has failed, it has gained press attention (Google never forgets) and in turn that tends to tarnish the whole PEO industry.

In response, some PEO industry leaders banded together through the National Association of Professional Employer Organizations (known as NAPEO), to construct a certification program and lobby the US congress for its implementation. To advocates, this program was viewed as a win-win for both the IRS and the PEO industry. The IRS gets increased confidence and oversight regarding the payment by the PEO of employment related taxes for the PEOs worksite employees and clients. In turn, certification advocates in the PEO industry were seeking a way to assure prospective clients that employment related taxes are being handled appropriately. Like any business, winning new clients is competitive and PEOs touting IRS certification are no doubt considering it will deliver a marketplace advantage.

Potential advantages for clients of a CPEO

-

Payroll Tax Liability

Clients who join a CPEO cannot be held liable for unpaid federal employment related taxes for the duration of their time in a CPEO relationship. Technically in a standard PEO relationship the IRS can legally hold a PEO client liable for unpaid employment related taxes in the event that the PEO failed to make the required tax deposits. In the very few cases we are aware of where the client payed the PEO and the PEO failed to make those tax deposits, the IRS has most commonly declined to pursue the PEO client for such monies. No matter how uncommon, it has remained a concern for PEO clients for years. Clients of a CPEO are released from that potential liability.

-

Wage Base Restarts – Successor Employer Treatment

The IRS provision for CPOEs allows them to be treated as a successor employer regarding federal employment taxes – FUTA and OASDI – social security taxes. These taxes are subject to annual wage cutoff thresholds. Some companies joining a PEO late in the calendar year have not been credited for earlier current year employment tax contributions due to the change in federal employer identification number (FEIN) reporting the wages. In the payroll world this is called a wage base restart. A company (and their worksite employees) that joins a CPEO midyear will not be required to restart wage base calculations for federal employment related taxes. This advantage will primarily affect PEO clients that have employees with annual wages over $127,200 – the social security tax threshold for 2017. PEO clients with average annual wages below this amount will not see much financial advantage in joining a CPEO versus a standard PEO in a midyear transition. This treatment also applies in reverse to any CPEO client that elects to leave the CPEO during the year. Since the CPEO program only covers federal employer taxes, successor employer status for state taxes (SUTA) will not be affected by the new certified PEO regulations.

-

Tax Credit Eligibility

In addition a client’s eligibility for other federal tax credit programs will not be impacted by using a CPEO. Since some tax credits eligibility accrues to the employer of record, some have questioned whether a PEO client can apply for tax credits when technically their PEO is the employer of record since form 941 wages are reported under the EIN of the PEO. Some of the more common employer based tax credits are:

- IRS Section 45B – Related to cash tip credits (common PEO clients in the hospitality industry)

- IRS Section 45R- Related to employee health insurance expenses for small employers

- IRS Section 51- Related to Work Opportunity Credit

- IRS Section 1396 -Related to Empowerment Zone Employment Credit

Under the new CPEO rules, it is now codified that all of the listed federal tax credits will be eligible to the benefit of the CPEO client and that a CPEO has the obligation to calculate and report the eligible financial amounts to their CPEO clients.For more details refer to Internal Revenue Bulletin: 2016-21, REG–127561–15 Section 6

Will joining a Certified PEO Cost More?

Since the CPEO program is just now getting underway, only time will tell whether PEOs charge their clients more in order to offer a certified PEO service solution. Each PEO who seeks and obtains IRS certification will have increased costs for maintaining program compliance and surety bonding. It can be expected that those higher operating costs have to be recovered somehow and might result in slightly higher fees charged to clients seeking an IRS certified services suite.

Potential PEO Industry Impacts

According to the National Association of Professional Employer Organizations there are from 780 to 980 PEOs operating in the USA. Smaller PEOs, may find the costs associated with certification (surety bonding in particular) to be much more marginally expensive than it will for larger PEOs who have a much higher number of clients to spread those relatively fixed costs. Over the years the CPEO program has been developing, we have spoken with our StaffMarket member PEOs about their plans for obtaining IRS certification. Many are excited to finally have clarity about lack of potential tax liability they can guarantee to prospective clients. Others have expressed dismay that the associated additional expenses incurred to obtain CPEO status may place them at a price disadvantage to some of the larger PEOs. Furthermore there has been industry grumbling that the larger PEOs have been pushing this program with the Department Of Treasury as a strategy to gain a marketplace price advantage and possibly force industry consolidation. Another possibility is that some smaller PEO operators will offer both a “certified” CPEO option as well as a standard PEO option to their clients, possibly at different price points. There is no doubt that many PEO clients enjoy the “high-touch” personal service of a smaller PEO. Let’s hope those clients of smaller PEOs who also demand certified PEO services are willing to pay a little more to get it.

Once the IRS names those PEOs who have obtained certified status, StaffMarket will track that information and StaffMarket analysts will be glad to review both standard PEO and CPEO solutions available that also meet your company’s other workers compensation, health insurance and HR needs.

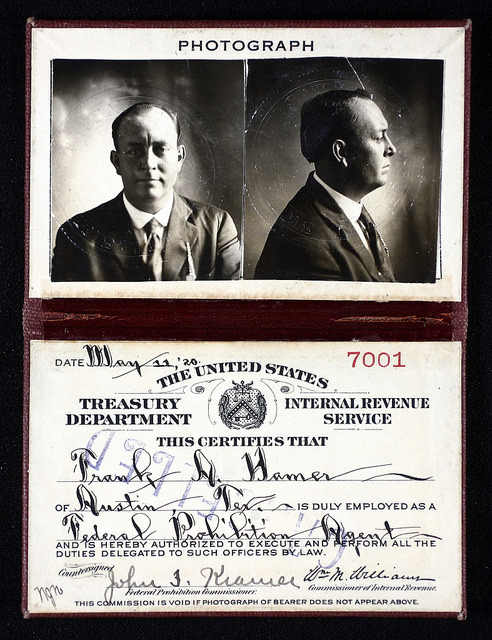

Photo credit to Dave Miller at Flickr. Note this photo is of the IRS agent Frank Hamer- responsible for killing Bonnie Parker and Clyde Barrow.