Inflation is up over 9% year over year since June 2021. The impact of rising prices is putting more strain than ever on small and medium sized businesses.

The impact of inflation and rising prices has become the top concern for businesses in the United States for quite a while.

Getting Inflation Defensive Strategies in Place

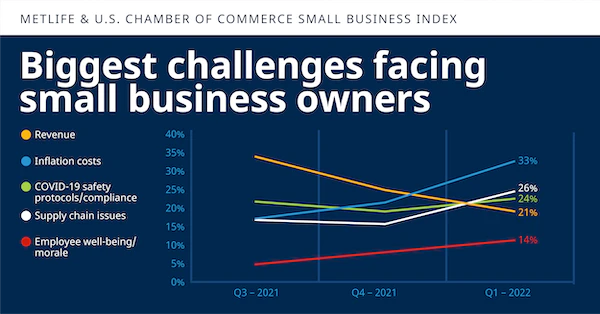

Larger businesses often have more cash reserves and more diverse revenue sources. Often operating within tight margins, many small and medium sized businesses have been adversely affected in the wake of COVID-19, supply chain disruptions, a tight labor market, and fear of an economic downturn.

These challenges happening simultaneously and compounded by inflation, means SMBs need to prepare defenses on multiple fronts at the same time.

Customers and Product Pricing

According to a study by the US Chamber of Commerce in March 2022, inflation pressures have caused 67% of small businesses to raise prices, with little relief in sight. Raising prices can have a negative effect on customers, especially for items with more price flexibility than essentials like gas and groceries. Obviously, customers dislike price hikes and business owners and managers must be aware of the delicate balance they have to strike to keep margins healthy while maintaining the customer’s trust.

Suppliers and Vendors

Rising prices don’t just affect your customers. Inflation also means the costs to run a small or medium-size business are rising. Many price hikes are the result of higher expenses born by suppliers. A survey from Business.org found that 9 out of 10 small business owners have dealt with rising costs of supplies and services since the start of the global pandemic. Around one in four of those surveyed have experienced hikes of around 20%.

Small and medium businesses must deal with inflation regarding their vendor and supplier partnerships also, which can not only strain their budget but may have negative effects on their personal relationships as well.

What it means for your team

It’s important to remember the key to your company’s success: your employees. The feel the strain from inflation both on the job and in their personal lives: when they buy groceries and fill up the gas tank, when they negotiate deals with vendors, when they interact with irritated customers, and when they get home and see bills stacking up. Economists and psychologists have noted that for many workers their emotional response to inflation makes them really upset. Managers should be aware that inflation is yet another stressor that hits workers at both work and home. In some cases managers may want to review their employee compensation arrangements and determine if they have the financial ability to improve that compensation in order to keep employees economically whole.

What you can do

With rising prices, it’s more important than ever to be a focused business leader at your small or medium-size organization. Pricing and sourcing decisions must be made carefully, and it’s a good time to look for ways to reduce spending where possible. If your business is paying for a service that you are not fully utilizing it may be a good time to reconsider if bearing that expense is worthwhile.

Depending on your business size, your industry and how leveraged you are, smart leaders can either look for more ways to cut operating costs or think of ways to grow and scale the company.

Employee satisfaction and engagement should be a priority, especially as employment numbers remain strong. Although you may not have the cash on hand for employee bonuses or raises to keep up with inflation rates, there are other policies you can implement to show your workers how much you care. That might include allowing for flexible work schedules to reduce the amount of money they are spending on gas. In addition, reviewing how competitive your total suite of compensation and employee benefits is with competing employers is a good way to keep your employees happier. If a bonus is not feasible, you could offer additional vacation days or other kinds of flexible policies to show that you realize the strain they have been under. Making employees feel like their situation is recognized in a work context is key to keeping them engaged.

Inflation is a particular kind of economic problem that attacks in multiple ways and smart small and medium-size businesses should prepare their defenses accordingly.