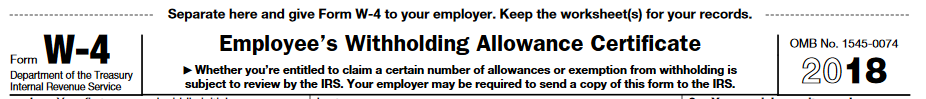

On February 28, 2018, the IRS issued its new 2018 Form W-4 and 2018 withholding tax calculator, along with additional guidance, to help taxpayers review their 2018 federal tax withholding elections in light of the newly passed Tax Cuts and Jobs Act of 2017 (TCJA or HR 1). Employers should share this information and the important IRS links below with all of their employees. If your company is currently in a PEO relationship, your PEO should be sharing this information with each of your workers.

Who must submit a 2018 Form W-4?

Employees with any changes to their withholding tax allowances should submit a 2018 Form W-4 to their PEO. In addition, employees who are exempt from tax withholding must submit a new 2018 Form W-4 to their PEO or their exemption may expire.

Due to the significant tax withholding changes in the new TCJA, employers should urge their employees to double check their withholding elections by using the new IRS withholding tax calculator linked below. Employees with updates should complete and submit their 2018 Form W-4 as soon as possible. A PEO cannot process any changes employees make to their withholding tax allowances or any withholding tax exemptions until they receive an updated 2018 Form W-4. Ask your PEO for instructions regarding how to advise employees to update their W-4 information.

If your employees have questions on how to complete their 2018 Form W-4, please see the information provided by the IRS in the links below or consult with your tax advisor.

IRS News Release: Updated Withholding Calculator, Form W-4 Released

https://www.irs.gov/newsroom/updated-withholding-calculator-form-w-4-released-calculator-helps-taxpayers-review-withholding-following-new-tax-law

2018 IRS Withholding Calculator

https://www.irs.gov/individuals/irs-withholding-calculator

2018 IRS Form W-4

https://www.irs.gov/pub/irs-pdf/fw4.pdf